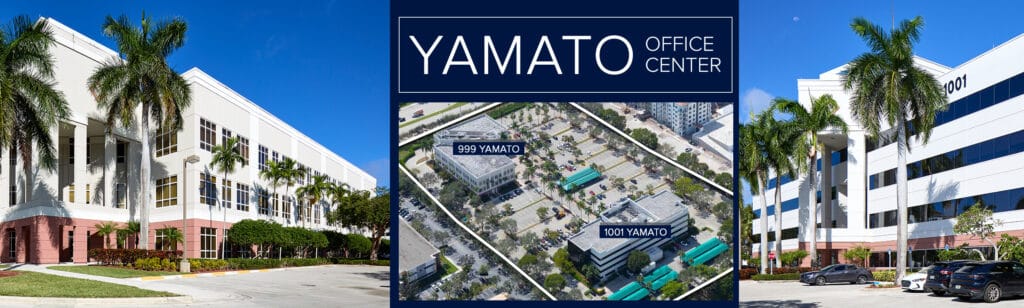

MHCommercial Real Estate Fund II (“MHCREFII”), a discretionary real estate private equity fund formed by Dung Lam, Neil E. Merin, SIOR, CCIM, and Jordan Paul, has closed on the purchase of Yamato Office Center in Boca Raton for $45,925,000 ($267/SF) in a joint venture partnership with an institutional real estate fund based out of New York. Yamato Office Center is a 171,724-square-foot office complex comprising two Class-A office buildings located at 999 and 1001 Yamato Road, Boca Raton, Florida. Yamato Office Center was approximately 71% leased at the time of the sale. Christian Lee, Marcos Minaya, and Sean Kelly with CBRE Capital Markets represented the seller, Adler Real Estate Partners (“Adler Partners”).

MHCommercial Real Estate Fund II (“MHCREFII”), a discretionary real estate private equity fund formed by Dung Lam, Neil E. Merin, SIOR, CCIM, and Jordan Paul, has closed on the purchase of Yamato Office Center in Boca Raton for $45,925,000 ($267/SF) in a joint venture partnership with an institutional real estate fund based out of New York. Yamato Office Center is a 171,724-square-foot office complex comprising two Class-A office buildings located at 999 and 1001 Yamato Road, Boca Raton, Florida. Yamato Office Center was approximately 71% leased at the time of the sale. Christian Lee, Marcos Minaya, and Sean Kelly with CBRE Capital Markets represented the seller, Adler Real Estate Partners (“Adler Partners”).

999 Yamato Road, built in 2000, is a three-story, 82,974-square-foot office building. 1001 Yamato Road, built in 1986, is a four-story, 88,750-square-foot office building. The complex is located near the entrance of the Park at Broken Sound and is situated on approximately 10 acres of prime Yamato Road frontage lending a generous parking ratio which includes covered parking. The Park of Broken Sound has recently benefited from a renaissance through the development of over 1,900 multi-family units and over 554,000 square feet of retail. Yamato Office Center’s prime location is a short drive to a large variety of nearby upscale amenities and 15 minutes away from transportation infrastructures including I-95, the Boca Raton Airport, Tri-Rail and the future Boca Raton Brightline Florida station.

MHCREFII is the second real estate fund for Neil E. Merin, SIOR, CCIM, Dung Lam and Jordan Paul after closing and fully deploying their first fund in December 2021 acquiring approximately $125 million in commercial real estate. MHCREFII launched in January 2022 and closed on its first acquisition in April 2022 with the $32.5 million purchase of EcoPlex® Office Center in West Palm Beach. Yamato Office Center is the second acquisition for MHCREFII with a target to acquire a total of $250 million of commercial real estate throughout the Southeastern United States over the next 12 to 18 months.

MHCREF and MHCREFII principals Neil E. Merin, SIOR, CCIM, Dung Lam and Jordan Paul stated, “We are very excited with the acquisition of Yamato Office Center at a purchase price well below replacement cost while also providing a tremendous opportunity to create value. Our plan is to reposition the asset as a premier Class-A office center primarily through capital improvements allowing Yamato Office Center to capture the robust demand for Class-A office space in Boca Raton. Boca Raton is one of the nation’s most attractive communities for wealthy decision makers and Yamato Office Center is specifically located in one of Boca Raton’s most rapidly urbanizing micro-markets.”

Corey Winsett, Director of Acquisitions for MHCREF oversaw the acquisition and due diligence process on behalf of MHCRFII’s JV partnership. Financing for the transaction was provided by LoanCore Capital a leading institutional lender that has financed over $25 billion in commercial real estate loans since 2008.

Steve Kay, Managing Director and JP Kost, Vice President structured the financing transaction on behalf of LoanCore Capital.

Elizabeth Jones and John Strickroot of the Shutts & Bowen law firm represented the purchaser on the transaction. NAI/Merin Hunter Codman will manage and lease the property. For leasing opportunities please reach out to Managing Director, Richard Brockey at 561-471-8000.

About CCIM

“CCIM stands for Certified Commercial Investment Member. For more than 50 years, CCIMs have been recognized as leading experts in commercial investment real estate. The CCIM lapel pin denotes that the wearer has completed advanced coursework in financial and market analysis, and demonstrated extensive experience in the commercial real estate industry.”

0 Comments

Leave a reply

You must be logged in to post a comment.